The State Administration of Foreign Exchange ("SAFE") of the People's Republic of China ("PRC") is the body that supervises the country's foreign exchange transactions. SAFE recently issued two circulars to encourage cross-border transactions: Circular No. 29 [2014] Provisions on Foreign Exchange Administration of Cross-Border Guarantee and Security (跨境担保外汇管理条例) ("Circular 29") and Circular No. 37 [2014] Issues Relating to the Administration of Foreign Exchange in Respect of Offshore Investments, Financings and Return Investments by Domestic Residents through Special Purpose Vehicles (国家外汇管理局关于境内居民通过特殊目的公司境外投融资及返程投资外汇管理有关问题的通知) ("Circular 37"). Circular 29 took effect on June 1, 2014, and Circular 37 was issued on July 14, 2014. Both support China's strategy for domestic companies to "go global" by relaxing restrictions on foreign exchange transactions.

Key Changes under Circular 29

Previously, overseas lenders found it difficult to get a PRC entity to guarantee or provide onshore security for loans made to that PRC entity's offshore affiliate. This was because under the prior legal regime, a PRC entity could not grant a guarantee or give onshore security for such offshore loans without SAFE approval. In practice, SAFE approval was rarely, if ever, given.

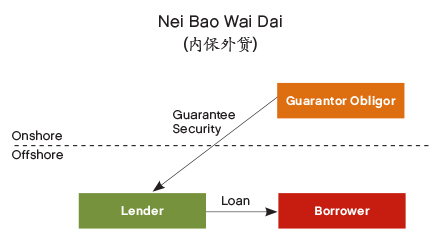

With effect from June 1, 2014, a PRC entity can give a guarantee or security over its PRC assets to secure offshore loans to its overseas subsidiary or parent without SAFE approval. Such guarantee or security only needs to be registered with SAFE within 15 working days of the execution of the relevant guarantee or security agreement. This method of providing an onshore guarantee or security for offshore loans, commonly known as "Nei Bao Wai Dai (内保外贷)" (as illustrated below), is expected to be widely welcomed by loan market participants.

Under a "Nei Bao Wai Dai (内保外贷)" structure, the offshore lender may enforce the cross-border guarantee or security without further approval from SAFE, provided that the relevant guarantee or security agreement has been duly registered with SAFE.

Circular 29, however, prohibits offshore loan proceeds from being repatriated onshore. This guards against speculative capital or "hot money" inflows that could destabilize the market. Further, once the cross-border guarantee or security has been enforced, the PRC obligor may not give additional guarantees or security until it has been fully indemnified by the offshore borrower. This guards against overexposure of the onshore obligor.

Certain Changes Under Circular 37

Circular 37 repealed Circular No. 75 [2005] Issues Relating to the Administration of Foreign Exchange in Respect of Financings and Return Investments by Domestic Residents through Offshore Special Purpose Vehicles (国家外汇管理局关于境内居民通过境外特殊目的公司融资及返程投资外汇管理有关问题的通知) ("Circular 75"), which had been in effect since 2005.

Under Circular 75, a special purpose vehicle ("SPV") was defined narrowly for the purpose of offshore equity financing. Circular 37 has expanded the purpose of the SPV from "equity financing" to "investment and financing." This allows an SPV to be established for overseas acquisitions.

Circular 37 also allows a PRC parent to lend to its offshore SPV, as long as there is a legitimate need. Again, this is likely to be widely welcomed by loan market participants since such shareholder loans are typically treated as "equity" in a lending transaction. A larger "equity" cushion from a PRC parent helps reduce default risk, and in turn makes the SPV a more attractive borrower for potential lenders.

Conclusion

To encourage offshore acquisitions by PRC companies, SAFE, through Circular 29 and Circular 37, has relaxed control over foreign exchange restrictions. SAFE's sanctioning of "Nei Bao Wai Dai (内保外贷)" provides certainty for market participants looking to lend against onshore guarantees or security. The expanded scope for SPVs under Circular 37 is expected to promote overseas acquisitions and related financing activities. It should be noted, however, that the actual implementation of Circular 37 is yet to be tested and may call for additional clarification.

http://www.jonesday.com/update-on-prc-cross-border-lending-transactions-08-20-2014/ |